After four rate rises since May, buyers are reducing their budgets and sellers are revising down their expectations from the highs of last year to meet the market.

More new homes have been listed for sale ahead of spring, a traditionally strong selling season, but interest rate rises are set to push prices down further. Photo: Rhett Wyman

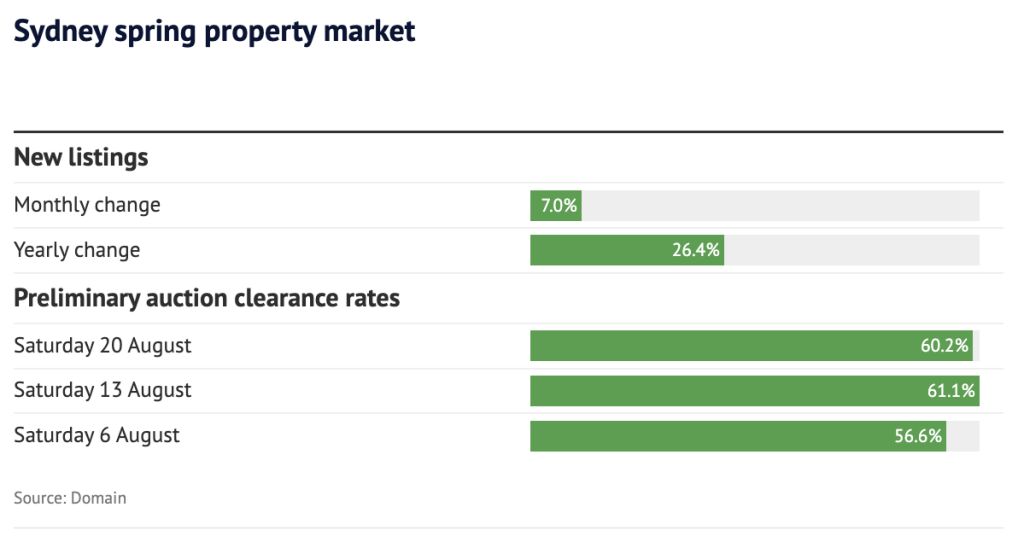

As buyers and sellers start to see eye to eye, Sydney’s auction clearance rate has improved for the fourth week in a row, sitting above 60 per cent for the first time since April on Domain data, while private treaty vendors offered the deepest discounts in almost three years at an average of 6.7 per cent off their original asking price.

More vendors are willing to put their home on the market, resulting in a 7 per cent increase in new listings in the four weeks ending August 21, compared to the previous four weeks, Domain data shows. Listings are 26.4 per cent higher than the same period last year, when Sydney was in lockdown.

But with another interest rate rise around the corner, ANZ and Westpac updating their Sydney house price forecasts to peak-to-trough falls of 20 per cent and 18 per cent, respectively, and buyer demand on listings websites showing signs of a drop, experts have reservations about how the spring property market will perform.

PRDnationwide chief economist Dr Diaswati Mardiasmo said the major headwind in this year’s spring market – a traditionally strong selling season – was the possibility of further rate rises.

Sydney spring property market Photo: domain

Sydney spring property market Photo: domain

“This spring season is really different to last year’s. The cash rate was held stable, whereas this year there is a question mark on what’s going to happen to the cash rate,” Mardiasmo said.

“If the cash rate goes up then a person’s borrowing power goes down, so it’s a race against time.”

She said this spring was crucial for buyers to get in before their borrowing power erodes further, and sellers to list before they achieve a lower result.

“[It’s] that really important season right now because there is a lot of uncertainty of what the cash rate is going to do,” she said.

“For a buyer it means they can afford less, and for a seller that means they may get a lower offer.

“We’re expecting that discount is going to widen a little bit more because of people’s borrowing power decreasing.”

BresicWhitney director Shannan Whitney said while there was some uncertainty in the market as the extent of future rate rises was unclear, buyers and sellers have adjusted to the downturn since the market turned earlier this year, prompting more new listings and improved clearance rates.

“We’re in for an uncertain spring. It’s driven by a little bit of uncertainty in where we are in the rates cycle – the uncertainty on lending rates, on buyers’ decision-making, which flows through to confidence around values,” Whitney said.

“I feel like we’ve still got more to go with that, and that’s going to flow into the spring months as we enter September.

“Pricing is still sensitive, no doubt, however we have passed a lot of the fear that comes in a change of cycle.”

Laing+Simmons chief executive Leanne Pilkington said while buyer sentiment was more positive than three weeks ago, it was unlikely the market would replicate last year’s blockbuster spring results.

“I don’t think we can expect to see what we saw last year. Interest rates and lending criteria will make sure we don’t see that level of activity again,” Pilkington said.

“There is no doubt that buyers are price conscious. People seem to know what is going on with interest rates and they’ve reset their expectations.”

Glebe sellers Laura Caloia and husband Quentin McKay have listed their townhouse in the hopes of capturing the start of the spring market and selling before there are any further falls.

They believe their freshly renovated house will sell well despite current conditions because of the scarcity of newly renovated homes.

“The market is becoming a little bit more unpredictable. We wanted to sell knowing what price range we could get, and we thought now was a good time,” the 34-year-old said.

“Since we’re auctioning on September 10, I think it’ll be a strong start to the season because it’s a really good-quality home, and a comfortable home.

“It’s fully renovated and ready to move in and enjoy. I think it will hold its value because of where it is.”

Their selling agent, Matt Carvalho of Ray White Surry Hills, said while they had more homes listed, buyers still do not have a lot to choose from and sellers are capitalising before further falls.

“Buyers have realised that the longer they wait, the less chance they have of buying good homes. A lot of good homes don’t sell when it’s at the bottom,” Carvalho said.

“Anyone coming onto the market knows it’s not where it was, but the smart ones also realise they are well ahead of where they were 12 months ago.”

article by domain.com.au